Margin buying power calculator

Required Rate of Return 64 Explanation of Required Rate of Return Formula. Shopify Profit Margin Calculator.

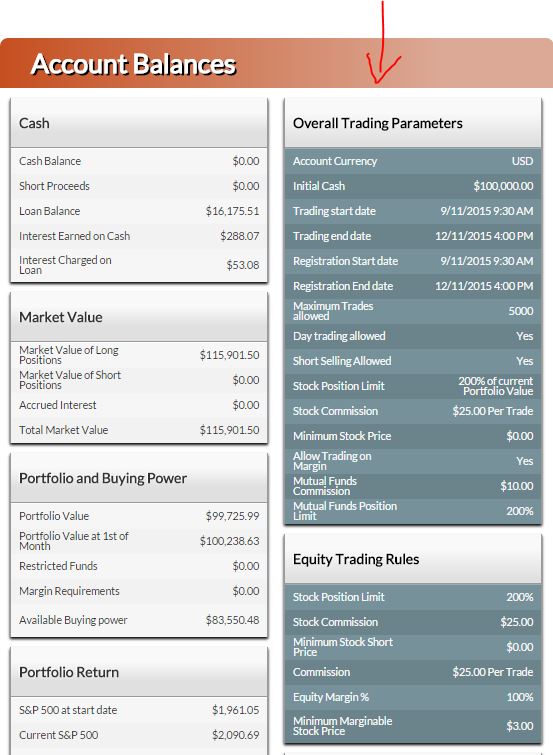

How Is My Buying Power Calculated Personal Finance Lab

Angel Broking Calculator Conclusion.

. This will often be in the form of a ratio such as 101 201 and so on. In the securities world margin is the money you borrow as a partial down payment usually up to 50 of the purchase price to buy and own a stock bond or ETF. Margin models determine the type of accounts you open and the type of financial instruments you may trade.

Practically any investments you take it at least carries a low risk so it is. When buying on margin the size of your deposit will depend on the leverage offered and the trading terms supplied by the broker. An investor must have a margin account to do so rather than a.

If you have 5000 in your margin account for example you could borrow an additional. If youre in the process of replacing your light bulbs consider looking at our LED Savings Calculator to see how much money you could save on your energy bill by switching to LED lighting. Find out how much you may be able to borrow and the potential costs involved in buying a home.

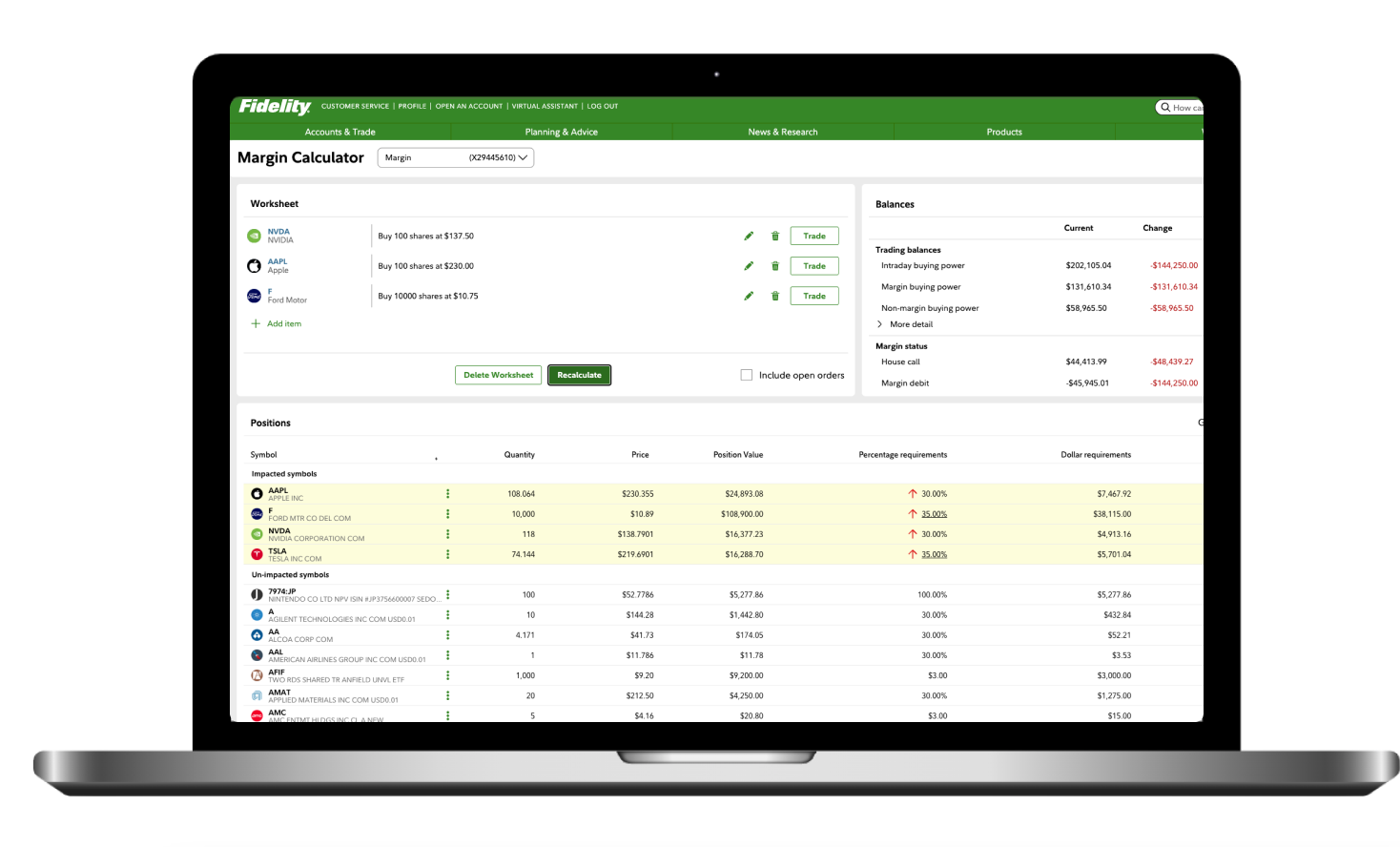

Understanding the difference is important. We suggest that you use the Margin Calculator to understand security-specific margin requirements to avoid exceeding this. A margin rate is the interest rate that applies when investors trade on margin.

What this means is that credit from sale of option contracts any profits from FO positions gets credited only the next day and any sale credits from equity delivery trades happen on T2 day. Using the Angel Broking Brokerage Calculator is pretty simple and seamless. In rules-based margin systems your margin obligations are calculated by a defined formula and applied to each marginable.

Lets say you want to purchase 100 shares of a specific company but you. A margin loan allows you to buy more investments than you could otherwise buy with a cash account. The Option Greeks sensitivity measures capture the extent of risk related to options trading.

Visit 5paisa now to calculate the FO Margins. Margin rates determine the cost of borrowing for the investor. The margin buying power on a restricted account is limited to the exchange surplus without the use of time and tick for a period of 90 days.

This balance is the amount available for day trading a long fully marginable position. Here are a few of the best options to choose from. Overnight buying power is represented by the amount you have available to buy securities and keep that position during the night.

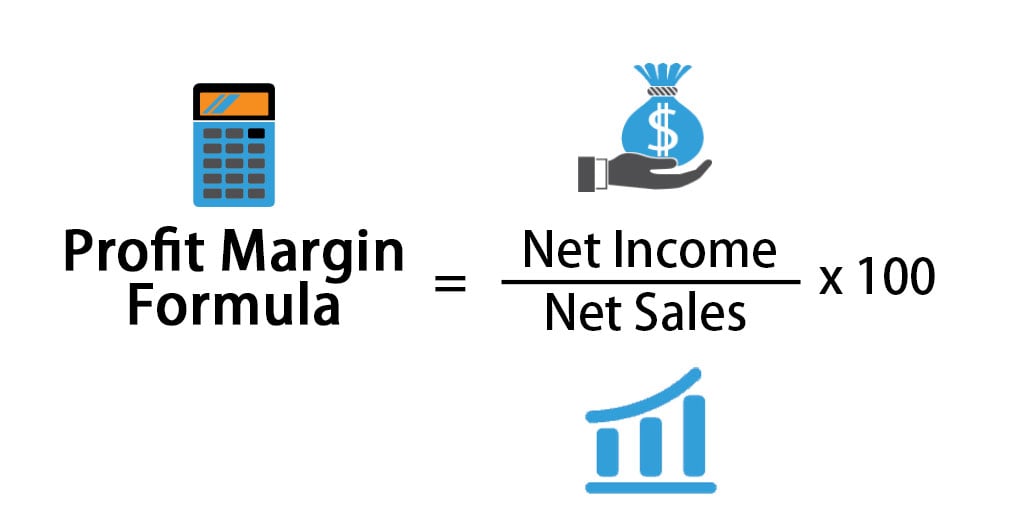

CD Calculator Compound Interest Calculator Savings. Required Rate of Return 27 20000 0064. Nevertheless there are many profit margin calculator tools online that do this job quickly.

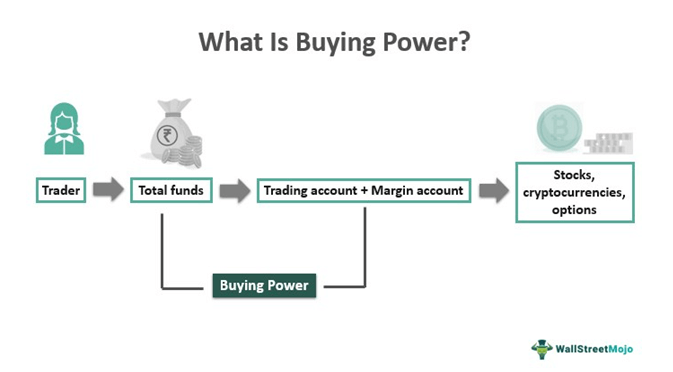

This practice is often referred to as buying on margin. Here is the step by step approach for calculating Required Return. This can effectively double your purchasing power.

Shopifys profit margin calculator tool helps you identify the selling price of your products that you should set. Use the Angel Broking Calculator wisely as per your motive and you will yield high returns. Overnight Buying Power and Day-Trade Buying Power.

Buying power comes in two types. We hope this article definitely helped you out. The settlement cycle in India is T1 day in case of FO Equity commodity currency and T2 day for Equity delivery.

Selling price or the desired profit margin of an item. Whether youre buying investing or managing your loan we can help today. Non-Margin Buying Power Options Mutual Funds Penny Stocks Margin buying power available to purchase securities that are not marginable have a 100 margin requirement.

Increased buying power. The Canon HS 1200TS may be small in terms of dimensions but this portable desktop calculator is enhanced with many sophisticated features. Available to Trade Without Margin Impact.

You can use a leverage multiplier to enhance your buying power. Calculate borrowing power Calculate borrowing power. As a result with its estimated selling price you.

Many brokerages use a tiered rate schedule based on the amount of the margin. Time and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. If you want to be a day trader then the 25000 minimum balance requirement will apply to your account at all times.

The calculator will ensure that you never have the. Trading on margin uses two key methodologies. Rules-based and risk-based margin.

Calculate comprehensive Span margin required for future options with the help of span margin calculator. The maximum dollar amount available to purchase a security without creating a margin debit in your account. This is the number of.

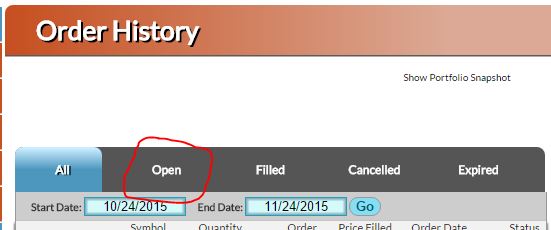

Margin trading is only accessible for people who have margin accounts with a net account value of under 2000. To help traders keep track of their balances Schwab displays a feature called Day Trade Buying Power DTBP which represent the amount of marginable stock that you can day trade in a margin account without incurring a day trade margin call. This payment is known as the initial margin.

As an example to produce 480-720 lumens of light might require 40W of power for an incandescent bulb but only 6-7W for an energy-efficient LED bulb. The 12 digit upright angled liquid crystal display provides large easy to read numbers for maximum viewing comfort. Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk.

To margin or buying on margin means to use the money borrowed from a broker to buy equities. Margin rates can vary from one brokerage to the next and there are different factors that affect the rates brokerages charge. Traders Zerodha FO margin Calculator part of our initiative Zerodha Margins is the first online tool in India that lets you calculate comprehensive margin requirements for option writingshorting futures and multi-leg FO strategies when trading equity FO Currency and Commodity on NSE and MCX respectively.

It makes your work easy and so does it cater to your profit making strategies. Margin Trading Facility MTF is a facility offered to an investor in buying of shares and securities from the available resources by allowing him to pay a fraction of the total transaction value called a marginThe margin can be given in the form of cash or shares as collateral depending upon the availability with the respective investor. Forex margin and securities margin are two very different things.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option trader to know how the changes in these variables affect the option price or option premium.

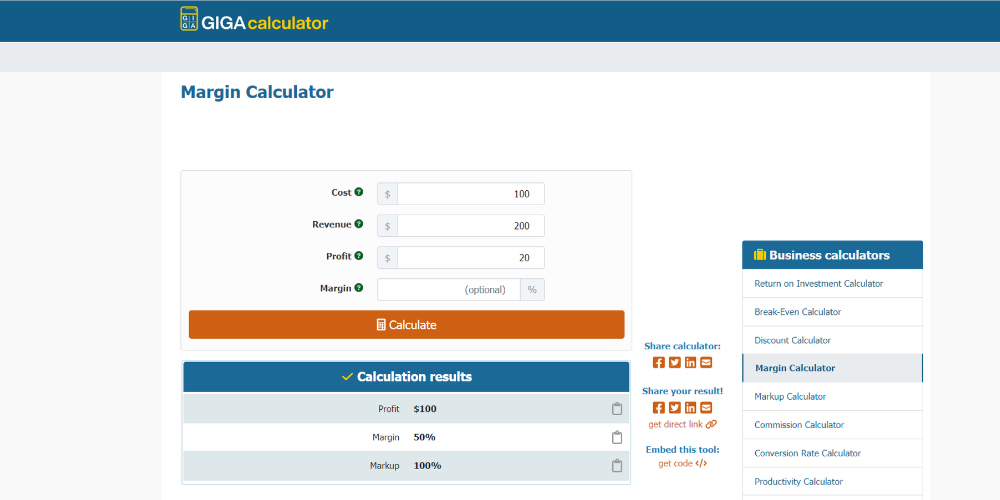

How To Calculate Margin Margin Calculators Geekflare

Buying Power Definition Examples Margin Calculation

Buying Power Definition Examples Margin Calculation

How To Calculate Margin Margin Calculators Geekflare

Margin Calculator Calculate Margin For Delivery Intraday Trading Dhan

Trading Faqs Margin Fidelity

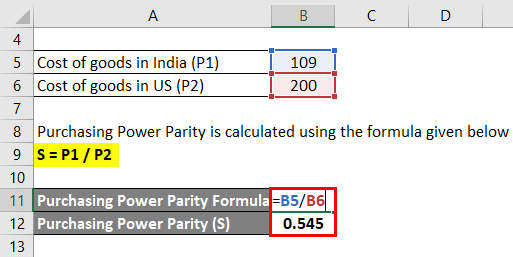

Purchasing Power Parity Formula Calculator Excel Template

What Is A Margin Call Margin Call Formula Example

Profit Margin Formula Calculator Examples With Excel Template

Gross Profit Margin Formula And Calculator

How To Calculate Margin Margin Calculators Geekflare

How To Calculate Margin Margin Calculators Geekflare

How Is My Buying Power Calculated Personal Finance Lab

How To Calculate Margin Margin Calculators Geekflare

Margin Trading Fidelity

What Is Margin Trading Things To Know Ally

How Is My Buying Power Calculated Personal Finance Lab